Notes: Include any additional info your customer should know, including terms of service and payment terms (for example, payments are due 30 days after the invoice has been issued). Total: Outline the total amount due from the customer, after tax. This is legally required to provide on invoices, and your rate may differ depending on where you run your business. Tax: Indicate the tax rate applied to the subtotal.

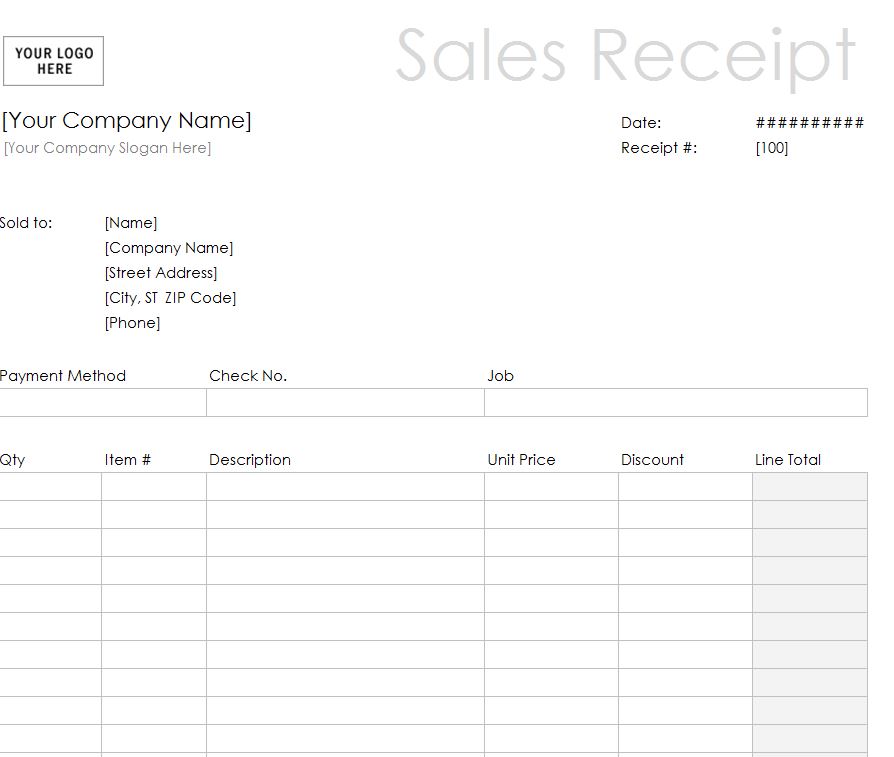

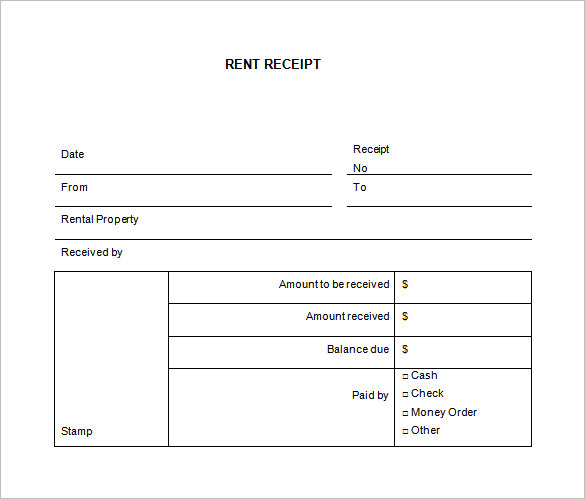

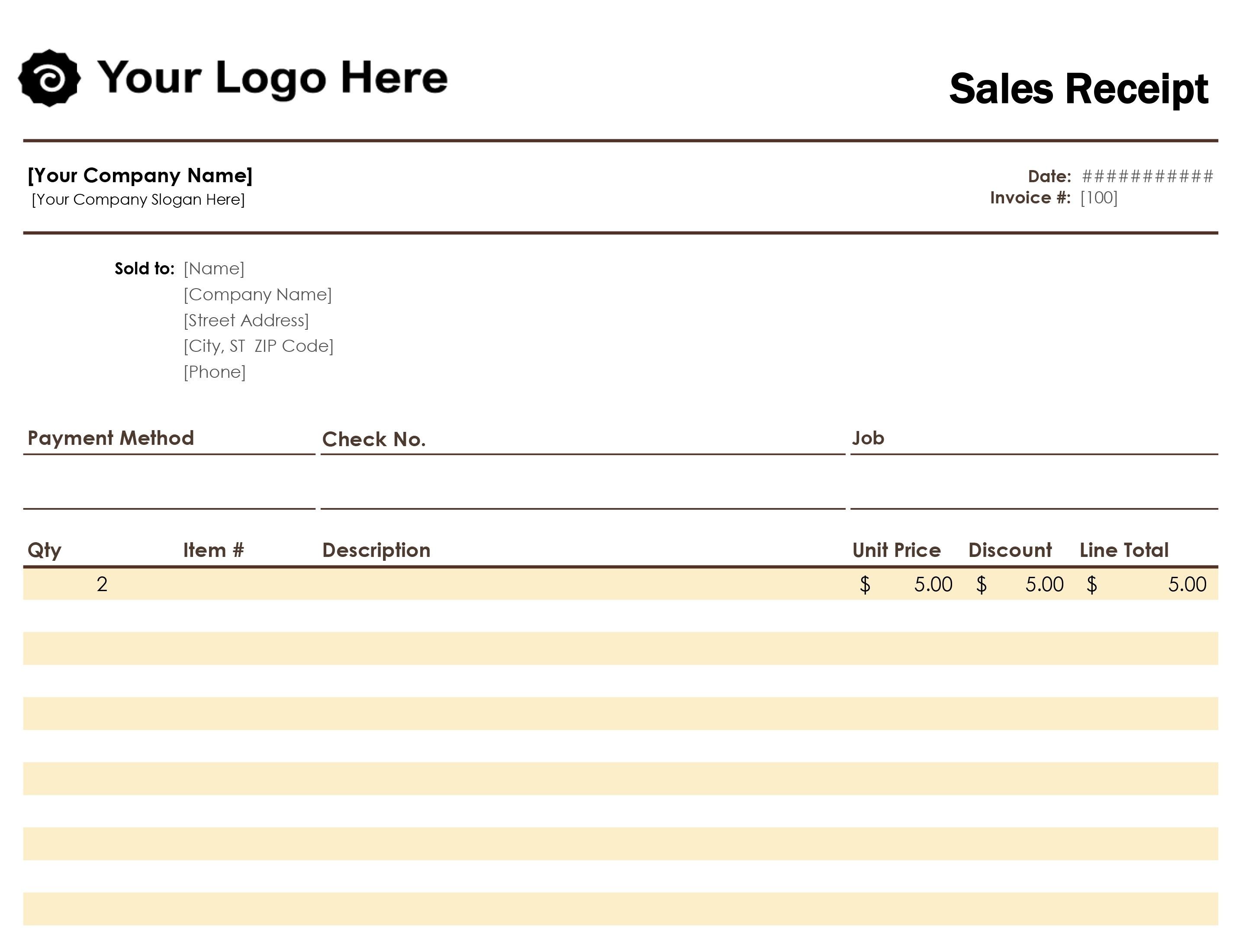

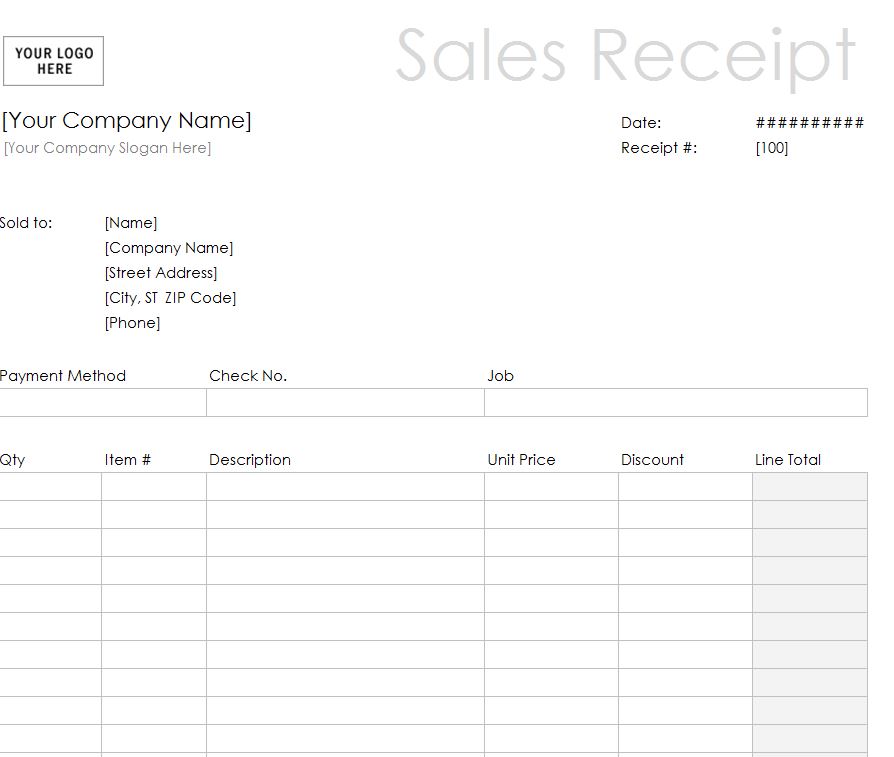

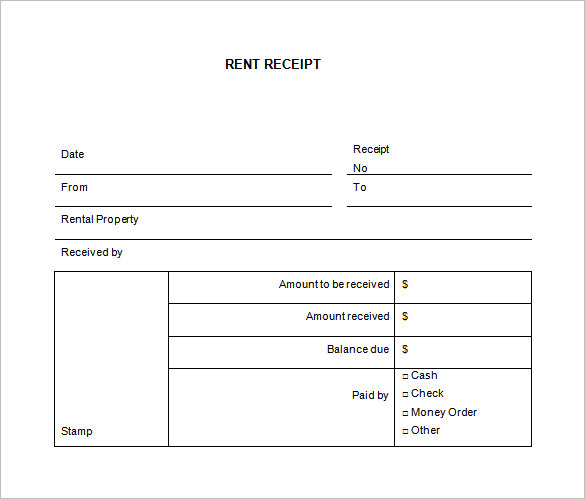

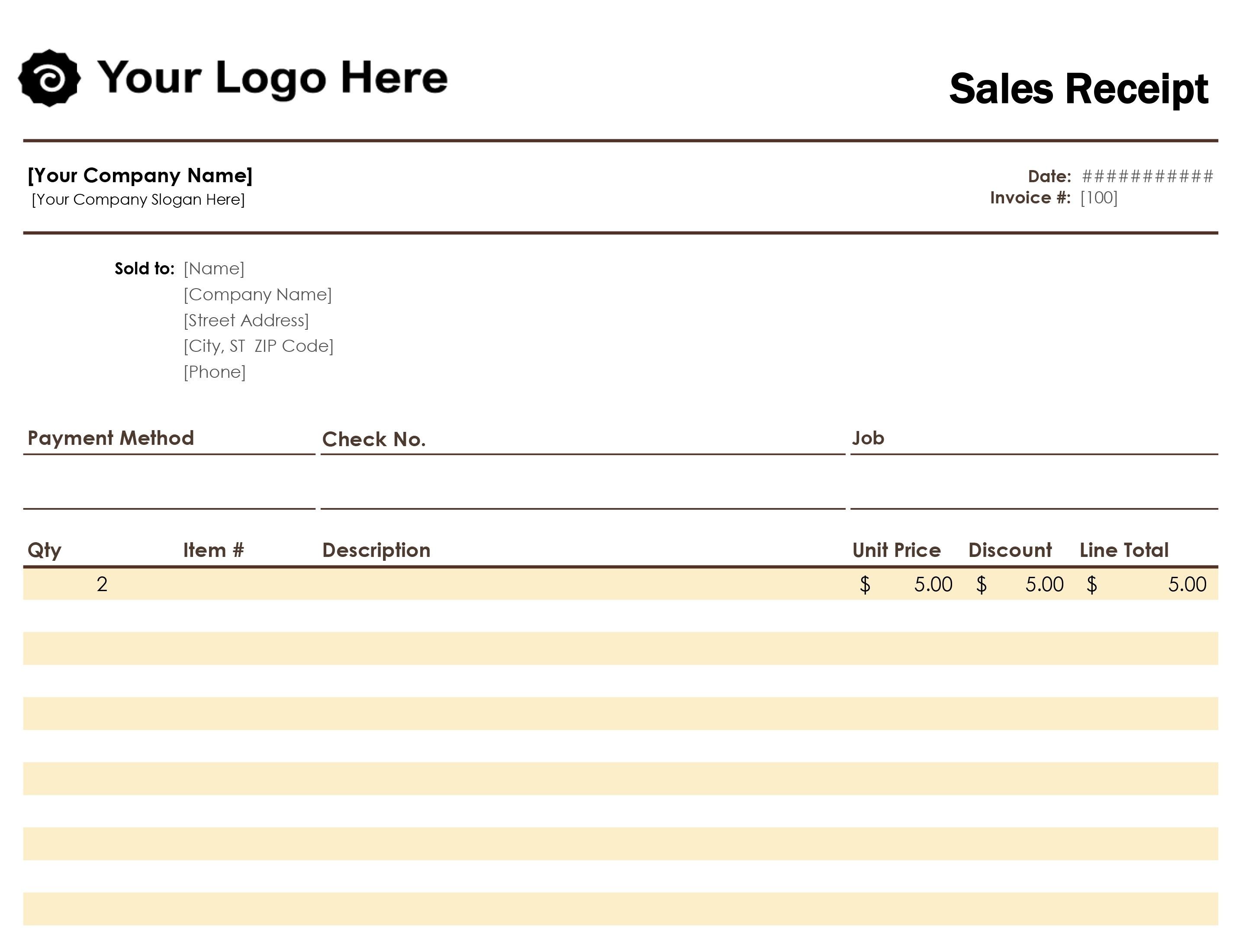

Notes: Include any additional info your customer should know, including terms of service and payment terms (for example, payments are due 30 days after the invoice has been issued). Total: Outline the total amount due from the customer, after tax. This is legally required to provide on invoices, and your rate may differ depending on where you run your business. Tax: Indicate the tax rate applied to the subtotal.  Subtotal: Add up the subtotal of your goods or services, before tax has been applied. For each line item, include a brief description, quantity, individual unit price, and total price. states, it is the 34th-largest by area.With a population of nearly 11. Line Item: Add individual line items for each unique good or service you provided. Ohio (/ o h a o / ()) is a state in the Midwestern United States.Of the fifty U.S. Dates: Include the date when your invoice has been issued and the date when payment is due. also known as a payment receipt or sales/cash receipt, is a commercial document sent by. For example, if you're sending your very first customer their first invoice, the invoice number could be 001-001. Create professional receipts online with a free receipt template. You can format this based on sequence and customer. Invoice Number: Include a unique invoice number to help you track down this invoice in the future.

Subtotal: Add up the subtotal of your goods or services, before tax has been applied. For each line item, include a brief description, quantity, individual unit price, and total price. states, it is the 34th-largest by area.With a population of nearly 11. Line Item: Add individual line items for each unique good or service you provided. Ohio (/ o h a o / ()) is a state in the Midwestern United States.Of the fifty U.S. Dates: Include the date when your invoice has been issued and the date when payment is due. also known as a payment receipt or sales/cash receipt, is a commercial document sent by. For example, if you're sending your very first customer their first invoice, the invoice number could be 001-001. Create professional receipts online with a free receipt template. You can format this based on sequence and customer. Invoice Number: Include a unique invoice number to help you track down this invoice in the future.

Customer Details: Under "Bill To", add your customer's name, address, and contact information.Company Details: Add your company name, address, phone number, and logo to the top-right corner.Title and Description: Name the project and briefly describe what type of work your client is being invoiced for.

0 kommentar(er)

0 kommentar(er)